If there is anything this year has taught us is that putting all your eggs in one basket is a faulty investment strategy.

With so many asset classes to choose from and the risk dynamics shifting drastically, should government bonds form part of a viable portfolio?

This article will look at bond investments in Canada and provide a balanced perspective on the rationale of investing in bonds in a recessionary environment.

But just what is a bond?

A bond is a financial instrument used by governments or corporations to borrow money. The bondholder lends a fixed amount of money to the issuer, who promises to pay back the amount known as the face value; over an agreed time period called the term; to get periodic interest payments called the coupon rate.

Governments issue bonds to fund public spending. Investing in government bonds is considered the safe route for preserving value, mainly because governments are less likely to default on payment; the bond provides a secure investment option.

The Canadian government issues bonds with maturities ranging from 1 to 30 years as shorter-term treasury bonds/bills of less than one year.

Pre 2008, Canadian government bonds were high yield instruments with yields as high as 4% up to 6.5% on the longer-term bonds. After the crisis of 2008, the government was forced to drive down interest rates to stimulate economic growth, which pushed down yields.

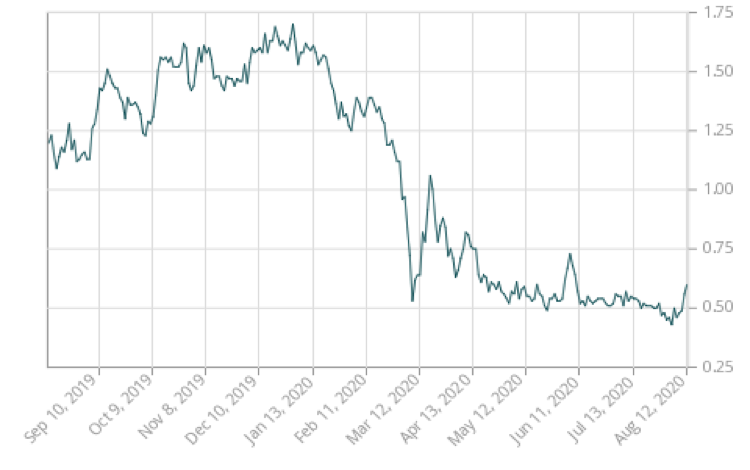

If you held a 10-year government bond In December 2019, the yield on the bond was near 1.75%. The pandemic caused a tumble in yields to 0.5% rebounding to 0.75 before declining to 0.5%.

While Canadian government bonds may not have highly attractive yields, it doesn’t mean that you should scrap off bonds from your portfolio.

Why invest in bonds?

● Buffer your portfolio.

Bonds remain a crucial part of an investment portfolio, mostly for their less risky nature. They act as a shock absorber to your investments against stock market losses in a bad market. More especially, government bonds are considered risk-free. The chances of the government defaulting on payments are very slim; after all, they have the keys to the printing press.

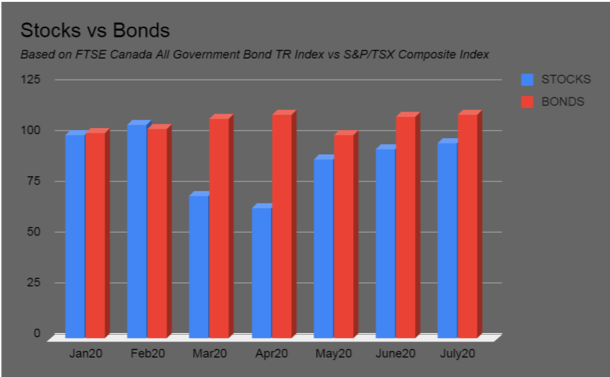

The stock market took a hard hit due to Coronavirus, but bonds emerged strong.

Having bonds on your list cushions your portfolio when the stock market or other investments are down.

With 2020/2021 forecasts still unsure when interest rates are expected to rebound, bonds are an excellent way to keep your investment safe.

● Long-term strategy.

Bond investments come with a lower risk tag, which is most suited for the less risk-tolerant. It is safe to say that any post COVID forecasts are highly speculative at best. We simply do not know when stability and a return to “normalcy” are expected. Taking a safe bet with bonds might be advisable to lower the portfolio risk profile.

If you are preparing for retirement, bond investments are still a good choice given their fixed investment and a steady flow of income, which you can reinvest. According to the IMF forecast, inflation figures are expected to remain at below 0.8% for 2020, despite the heavy use of the printing press.

If you hold the bond to maturity, there is no real loss of value if inflation hovers at these forecast levels. If you are in it for the long haul, bonds are still good value for your portfolio.

● Multiple strategies.

There are more liquid options for investing in bonds to consider. You can trade ETFs or mutual funds with bonds as the underlying assets. This gives you the best of both worlds, a liquid investment coupled with the security of bonds.

ETFs are passive investments that track the performance of a particular bond index while mutual funds are actively managed instruments.

As with any investment, there is an upside potential and a downward risk factor. What are the risk factors to consider?

● The secondary market for bonds is very shallow. You might not be able to find a buyer if you need to cash out for an emergency, for example.

● The price to pay for safety is the opportunity cost of higher returns. While there is safety in bond holding, they also lower the average returns on your portfolio.

THE TAKEAWAY

Even though yields are low and economic forecasts are subdued, government bonds still have a role to play in balancing your portfolio. The extent of exposure will depend on individual factors, but a general rule of thumb is to subtract your age from 110. This means if you are 30, you should have an 80/20 split between stocks and bonds.